Risk is a potential threat to every investment, no matter how large or small. It could be as simple as bad weather threatening an agricultural investment, or as complex as global geopolitics or a pandemic outbreak impacting the entire world and financial markets. For any investor, addressing risk and managing it appropriately is one of the keys to building towards a positive outcome. To do so requires knowing what risks you face.

What is Tail Risk?

What is Tail Risk?

Tail risk refers to an unlikely event. To get at the heart of the question, let’s go back to statistics 101 for a moment.

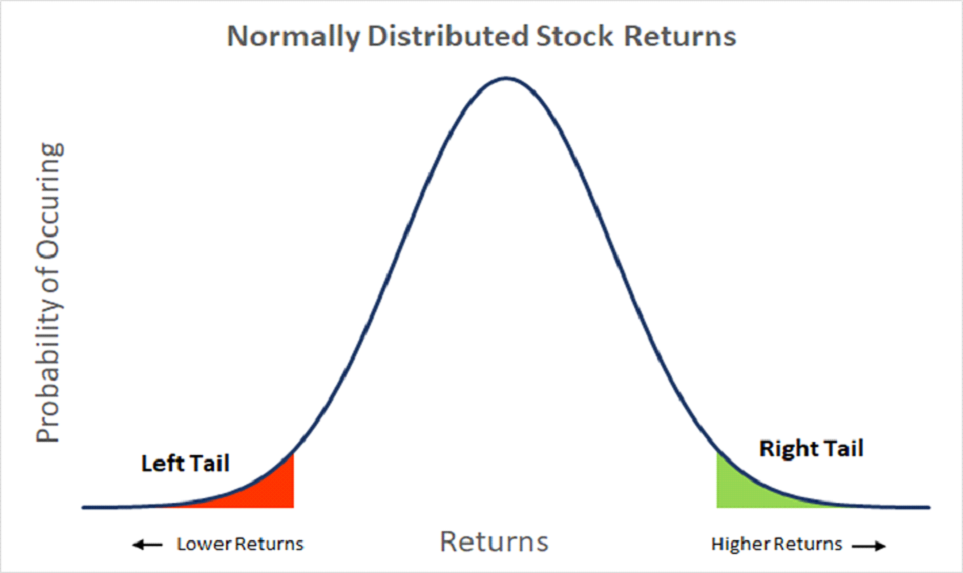

In a “normal distribution” that measures how close any given result is to the average expected result, there are “tails” at either end of the chart representing the most unlikely outcomes. In the financial world, one common definition considers the tails to be any result which is three or more standard deviations away from the average. For example, the right tail risk of a stock, or positive tail risk, would represent an upwards move much larger than average, accounting for the regular volatility of the stock. Of course, left tail risk is what concerns most investors.

Commonly cited examples of tail risk events include the 2008 financial crisis and the COVID-19 pandemic, which we are experiencing now. These are extreme outlier events that negatively impacted many investments. Tail risk is one of the biggest potential threats to your portfolio, but it is also one of the hardest to manage — the only way to guard against it fully would be to see the future with a crystal ball.

So, Is Diversification the Solution?

In most investment strategies, diversifying the portfolio is often enough to mitigate a considerable amount of risk. By limiting your exposure to the threats faced by certain asset classes and spreading your money around, a sudden downturn in one area won’t sink your entire investment. In a tail risk scenario, however, when a large-scale event causes broader problems, diversification will not always be enough.

Just as a rising tide lifts all boats, a tsunami sinks them. In market tail risk scenarios, equity correlations tend to rise. In addition, other asset classes with historically low correlations to equities may not act as a good protector against these events (look no farther than the real estate market in 2008). If you do not adequately account for tail risk, these sudden and unpredictable events become much more difficult to weather. However, pulling your money out of the market is not a good long-term strategy, and a strategy that is too low-risk won’t generate appreciable returns. What’s the solution?

Active Risk Management

Active management of your investments and a dynamic approach to those assets can help you to build in some protections against tail risk events, which could include making changes as necessary in the allocation of funds and hedging your investments with the proper tools to better withstand a storm of financial turmoil.

The usage of machine learning algorithms and AI could revolutionize the way investors approach tail risk. Although these events might be outliers, planning for them by effectively and actively managing investments may help to limit their impact on your portfolio. Hedging against a market catastrophe might not be easy, but it is a necessity — and good insights make the difference.

The views expressed represent the opinion of Passage Global Capital Management, LLC. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute as investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Passage Global Capital Management, LLC believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Passage Global Capital Management, LLC’s views as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumption that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements.