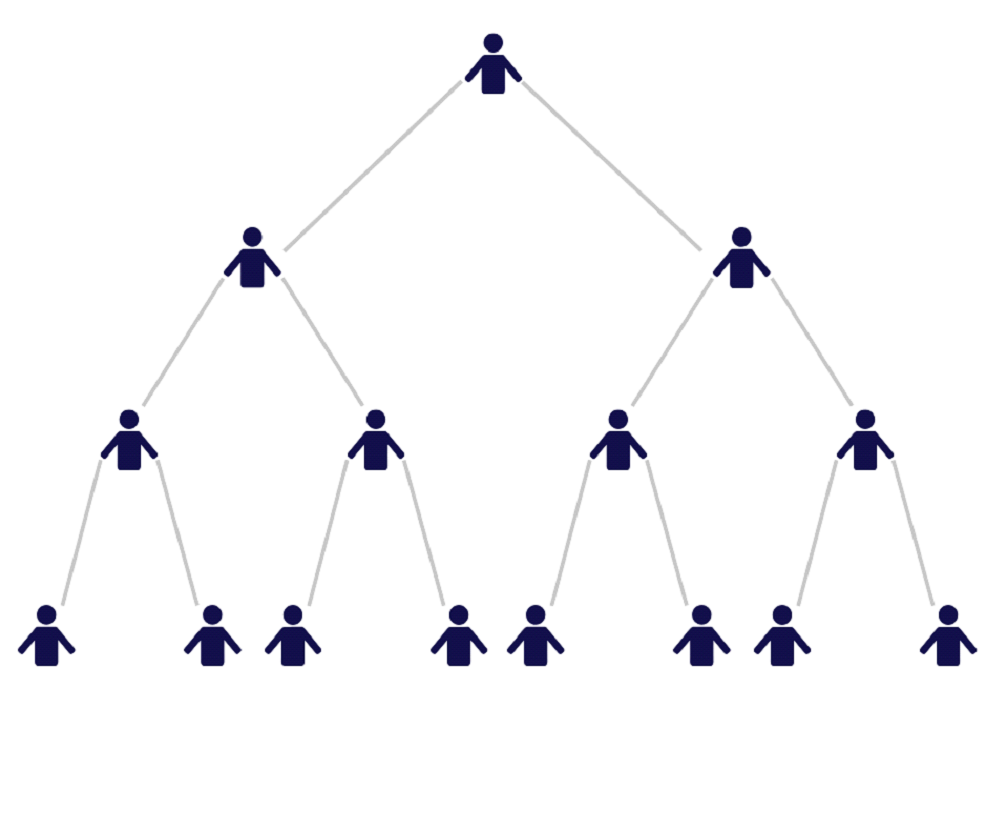

The “R naught” (pronunciation of the term R0) is not an often-heard vocabulary word unless you saw the 2011 American medical thriller movie “Contagion” about a worldwide pandemic of a new virus. It is also often encountered in the epidemiology as well as public health literature, and it is a crucial part of public health planning during an epidemic like the current coronavirus (Covid-19) outbreak spreading widely in China and around the world. The basic reproduction number (R0), also called the basic reproduction ratio, is an epidemiologic metric that was first formulated in the 1970s by the German mathematician Klaus Dietz. It is used to represent the average number of people that an infectious individual will infect in a specific population. The potential size of an outbreak or epidemic often is based on the magnitude of the R0 value for that event. In the early stages of an outbreak, R0 is estimated to be around two, which suggests a single infection will, on average, become two, then four, then eight and so on. This can be seen from past outbreaks such as pandemic flu as well as Ebola and now with coronavirus.

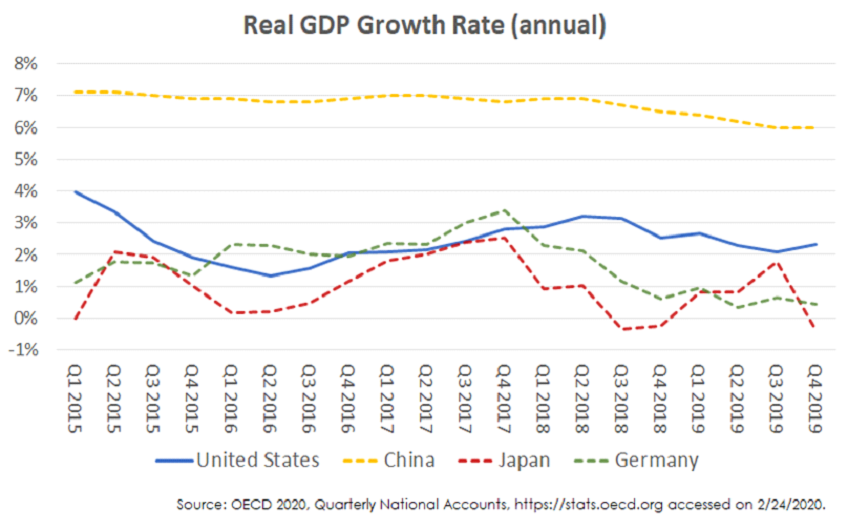

There are also economic consequences and financial risks given the fact that the Chinese economy is now more than four times larger than it was at the time of the 2003 SARS outbreak and it is considerably more vital as a source of demand and for its central role in many manufacturing supply chains. ANZ predicts Chinese growth in gross domestic product could fall to as low as 3.2% this quarter, half the rate of the first three months of 2019.

An expected slowdown in China also comes at a time when the eurozone economy is growing at the slowest rate in seven years. This is particularly true for Germany’s export-oriented economy. Deutsche Bank’s chief economist estimated that the coronavirus outbreak would knock 0.2 percentage points off first-quarter growth for Germany, making a technical recession quite probable after zero growth in the fourth quarter.

The views expressed represent the opinion of Passage Global Capital Management, LLC. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute as investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Passage Global Capital Management, LLC believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Passage Global Capital Management, LLC’s views as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumption that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements.