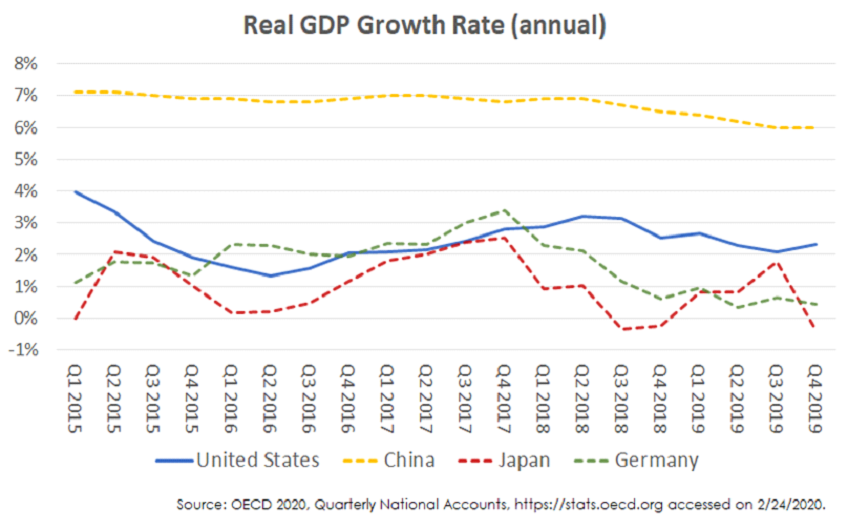

When the Fed ended its two-day November policy meeting, it raised the target federal funds rate by three-quarters of a point for a fourth straight time. Its key rate now stands in a range of 3.75% to 4%, the highest in 15 years. It was the central bank’s sixth rate hike since January of this year, which is the fastest pace in decades as it continues its fight to beat back elevated and persistent inflation by slowing economic growth. Investors hoping for the Fed to signal a more dovish tone were disappointed by Federal Reserve Chairman Jerome Powell’s message that rates would stay higher for longer to battle inflation. The year-over-year inflation is currently more than 8%, far above the Fed’s 2% target with few signs yet of cooling off. Core CPI, which strips out the volatile food and energy components accelerated 0.6% in September and was up 6.6% from a year ago, which was the highest pace since August 1982.

However, these rate hikes work with “long and variable lags.” The phrase was coined by famous Nobel-prizewinning American economist Milton Friedman to explain the delayed and uncertain effects of monetary policy in the economy. Raising rates should cause growth to slow down and in turn should lead to lower inflation. However, it can take time for the full impact to be felt; hence Friedman’s idea of a long lag. The variability, meanwhile, refers to the lack of a predictable interval between rate hikes and their results. As a matter of fact, The International Monetary Fund said last month that interest rate changes have their peak effect on economic growth in about one year and on inflation in three to four years. In the U.K., a 1 percentage-point increase in the policy rate reduces output by 0.6% and inflation by up to 1 percentage point after two to three years, according to a 2016 paper by James Cloyne, then of the Bank of England, and Patrick Hürtgen of Germany’s Bundesbank.

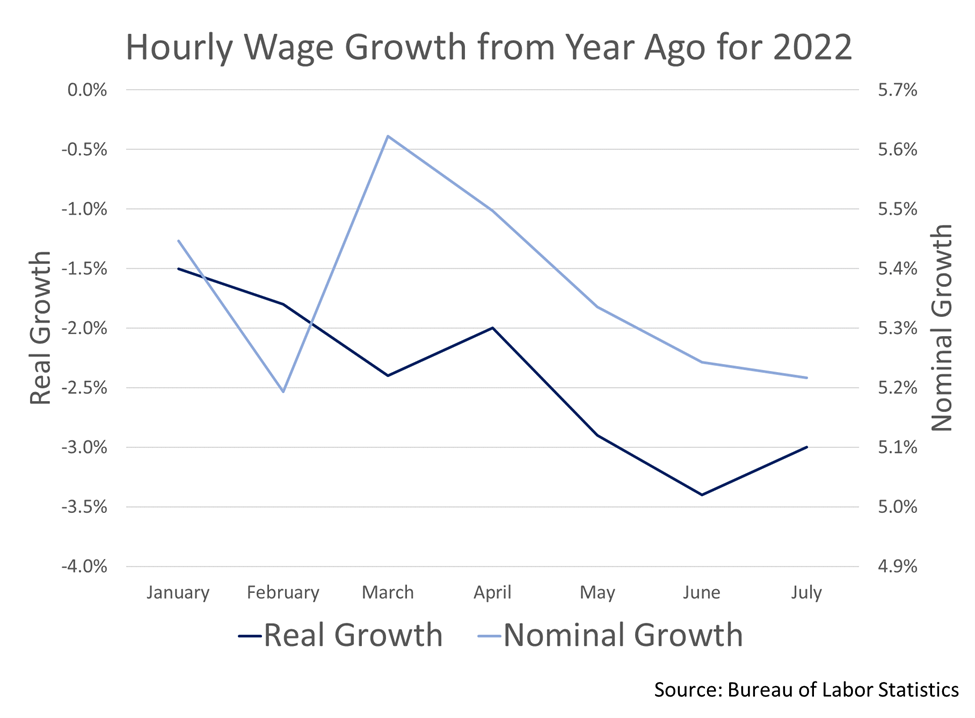

This means that the effects of the global expansionary monetary policies implemented in response to the Covid-19 pandemic induced recession are still being felt. These policies were designed to increase the supply of money and credit to generate economic growth. Meanwhile, the recent consecutive rate hikes have barely cooled either inflation or the labor market at this point.

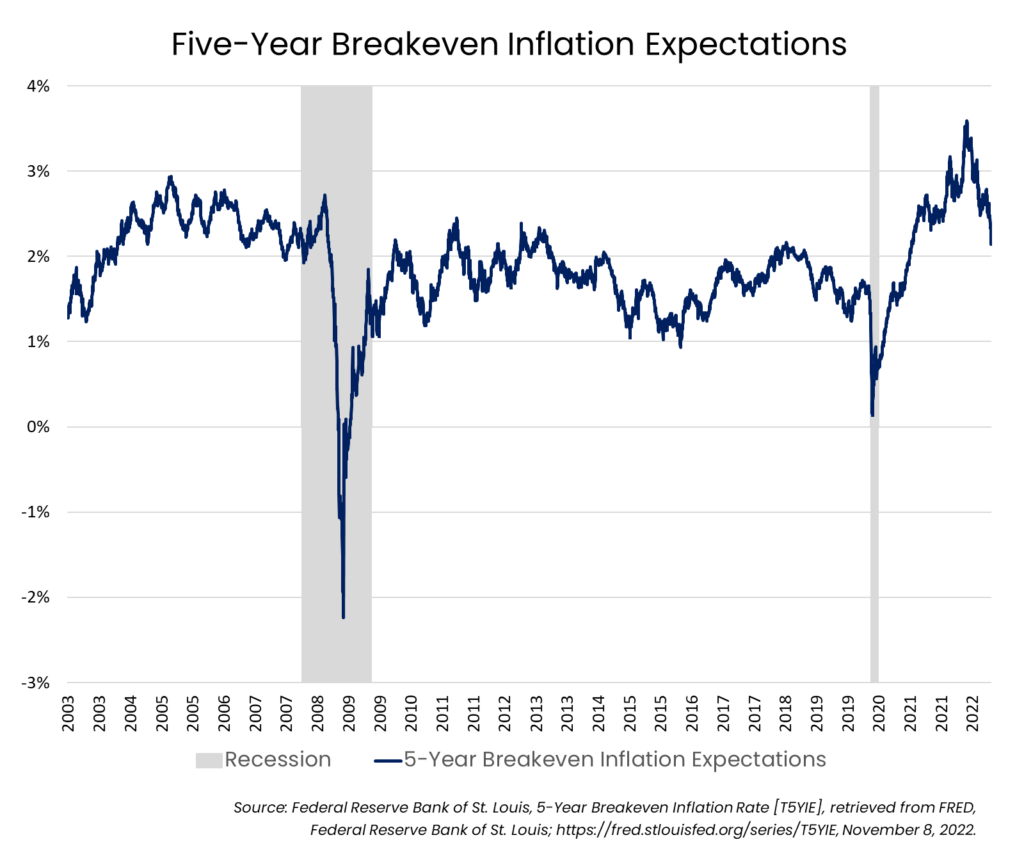

However, investors and economists are expecting the Federal Reserve’s aggressive interest rate increases to eventually curtail inflation. A widely followed measure of investors’ annual inflation expectations over the next five years, the five-year break-even inflation rate, stood at 2.61% in early November. It reached a record high of 3.59% in March of 2022, and since then it has been coming down gradually, implying investors expect inflation to decline significantly over the next five years. The record low was -2.24% in November of 2008.

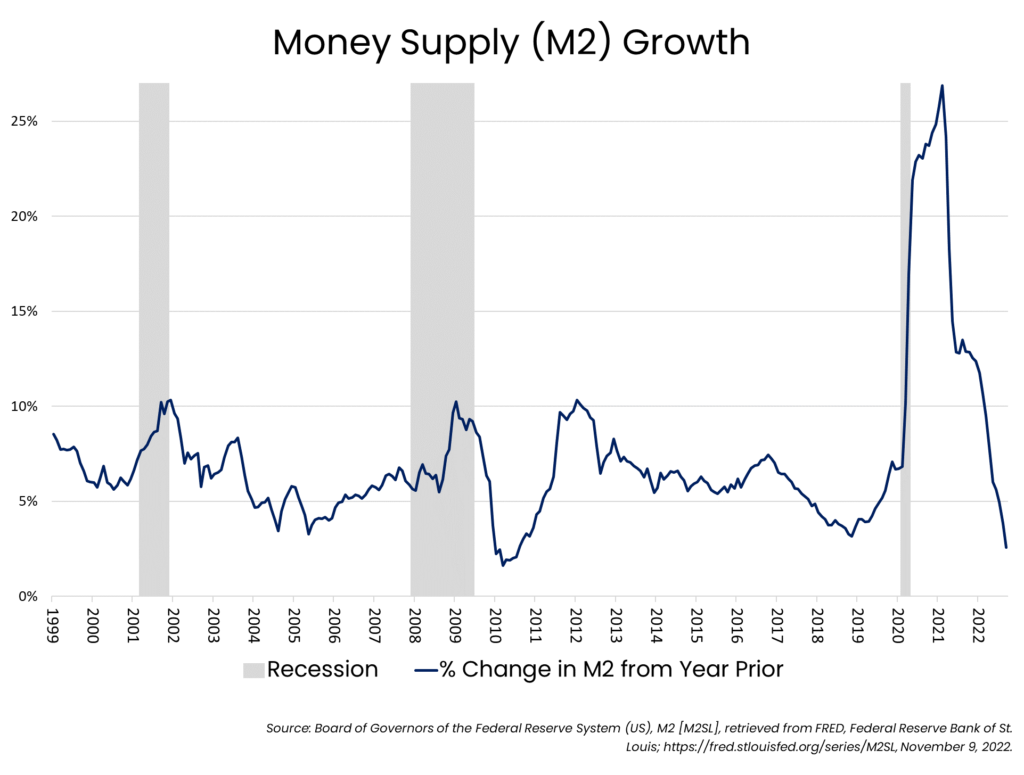

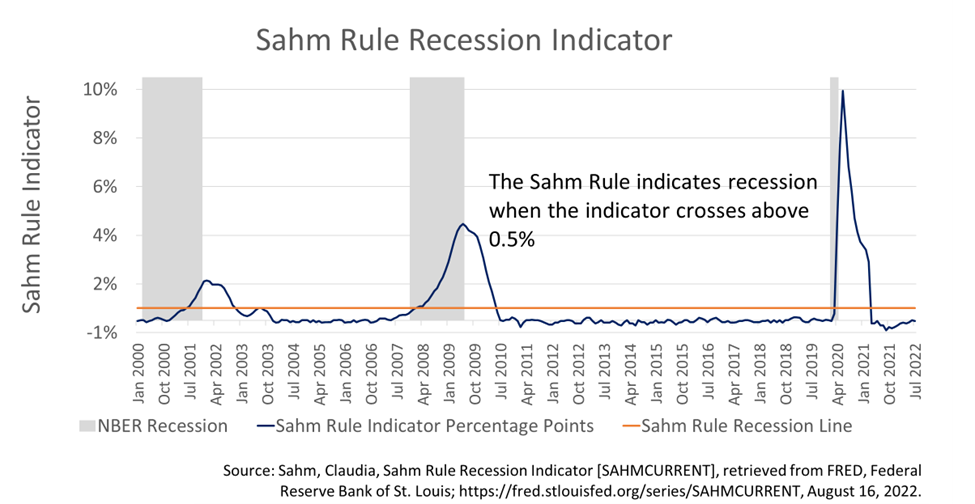

Another economic metric indicates an impending economic slump and a looming recession. In recent months, a measure of the money supply called M2 that includes cash, checking deposits, and easily-convertible near money has been falling. In September, the M2 growth rate was 2.56 percent. That’s down from August’s growth rate of 3.82 percent. September’s rate was also well down from September 2021’s rate of 12.87 percent. Recessions tend to be preceded by decelerating money supply. However, the money supply growth rate has a tendency to subsequently start ticking up again before the onset of recession.

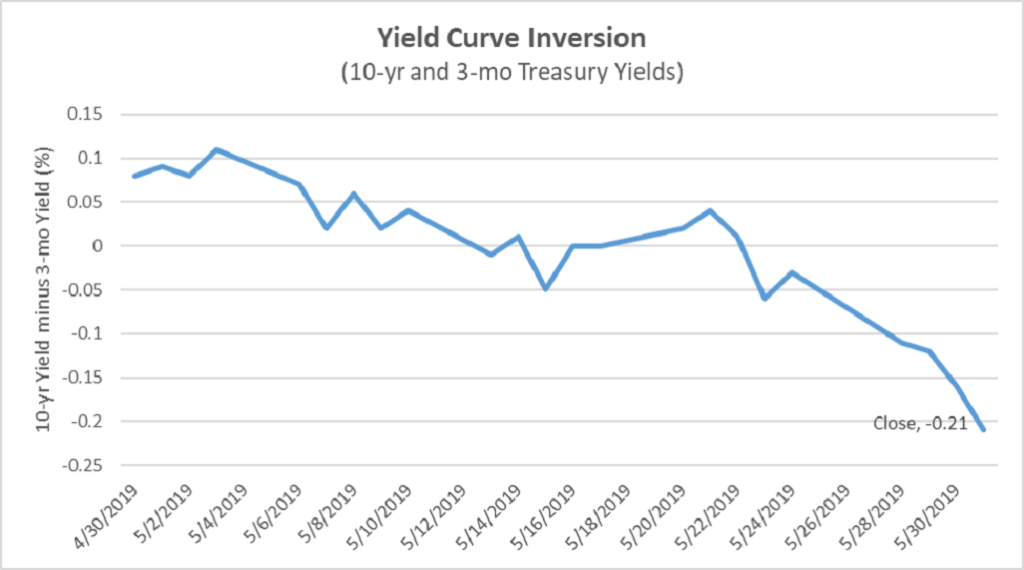

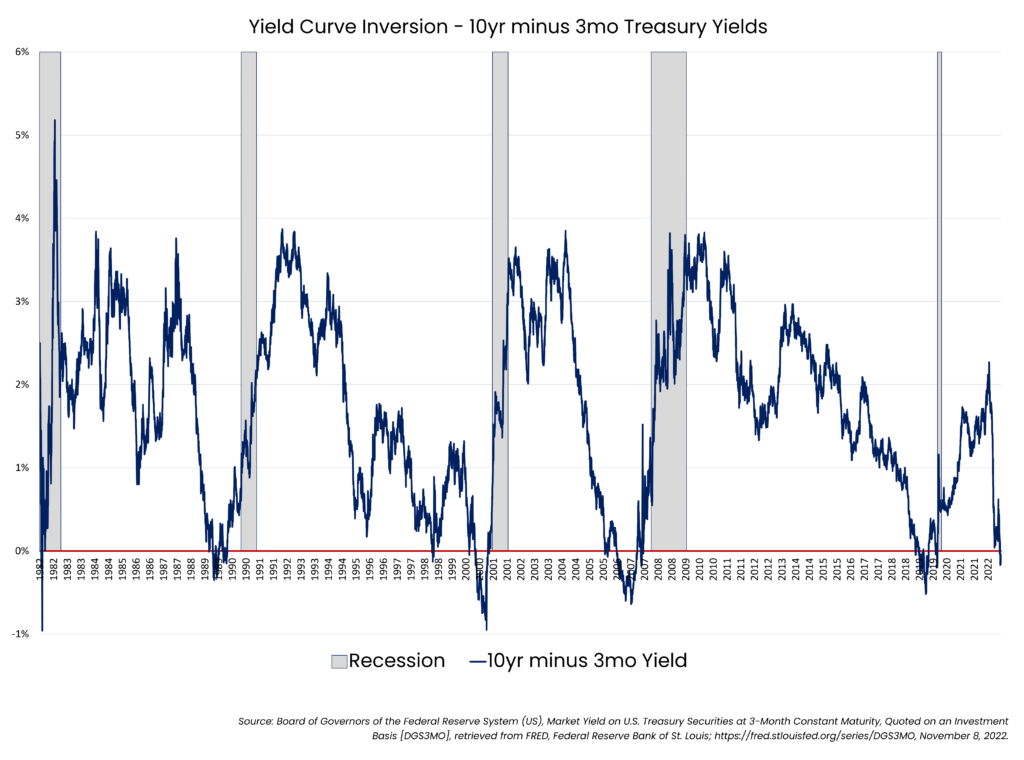

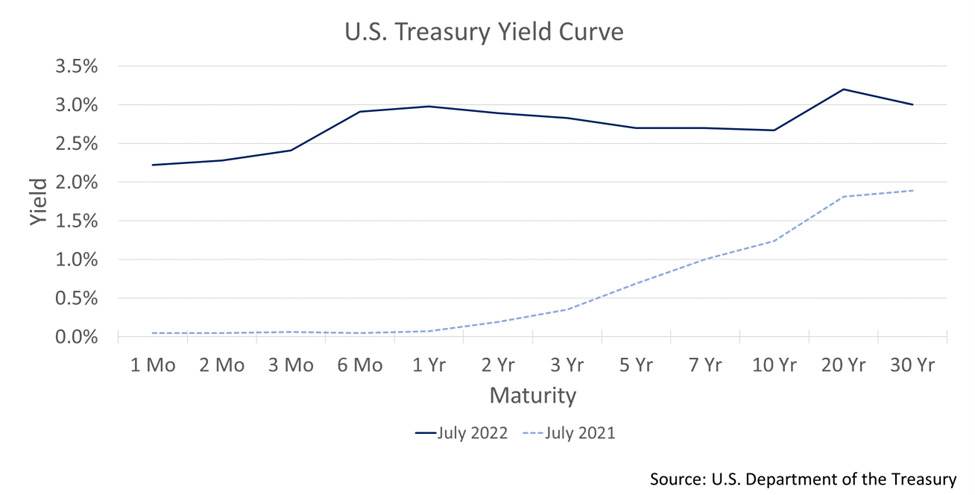

It is no surprise that key yield-curve indicators favored by Wall Street have also started to signal that the United States is heading towards an economic slump – perhaps within a year. In October, 10-year Treasury yields fell below 3-month Treasury yields, creating a so-called yield curve inversion. This signals that investors desire more compensation for buying short-term bonds as compared to longer-term bonds in response to the Fed’s rate hikes and slower anticipated growth. An inversion occurred earlier this year between 10-year and 2-year Treasuries, and in early November, the spread between these yields touched a level not seen since the early 1980s.

The Fed is well aware of the rate-effect lag, and this could create the risk that the Fed might ease off too soon. This is especially true if the hot job market starts to cool and people begin losing their jobs. Recent announcements of some technology companies cutting their workforce, including Twitter and Meta’s upcoming large-scale layoffs, could spill over to other industries. This could prompt a reaction from the Fed to stop increasing rates too early while prices are still rising. Investors may then conclude the Fed isn’t committed to fighting inflation. This would hurt their credibility, especially when they were too slow to begin raising interest rates in the first place.

But lags carry the opposite problem, too. The Fed could instead keep increasing and holding interest rates too high for too long to preserve their credibility, especially if upcoming inflation data continues to run hot as we’ve seen recently, risking potentially a deeper recession than is necessary.

This rate-effect lag is the conundrum facing the Federal Reserve today and let’s hope the Fed can still achieve a so-called “soft-landing.” Policy mistakes from the Fed in the United States may have more profound ripple effects for the global economy. If you are a student of world affairs, you may know the phrase “when America sneezes, the world catches a cold.” Let’s hope that no one gets a cold before we head into the winter months.

The views expressed represent the opinion of Passage Global Capital Management, LLC. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Passage Global Capital Management, LLC believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Passage Global Capital Management, LLC’s views as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements.

Consumer spending, which makes up more than two-thirds of U.S. economic output, grew at a 0.9% annual rate in the first quarter, compared with a prior estimate of 1.3% – a sharp slowdown from the fourth quarter, when consumer spending increased at a 2.5% rate.

Consumer spending, which makes up more than two-thirds of U.S. economic output, grew at a 0.9% annual rate in the first quarter, compared with a prior estimate of 1.3% – a sharp slowdown from the fourth quarter, when consumer spending increased at a 2.5% rate.